Q3 2024: Strong performance, lingering questions

Kurt Rosentreter, CPA, CA, CFP, CLU, CIMA, TEP, FMA, CIM

Senior Financial Advisor & Portfolio Manager, Manulife Wealth Inc.

President & Life Insurance Advisor, Upper Canada Capital Inc.

Global markets performed well in the third quarter of 2024, continuing their positive trend this year. This was influenced by factors such as strong corporate profits, lower inflation, and interest rate cuts by central banks worldwide.

The S&P 500 Index, S&P/TSX Composite Index, and MSCI World Index increased by 20.8% (USD), 14.5%, and 17.5% (USD), respectively, in the first nine months of the year.* Bonds also performed well. Canadian and U.S. bonds, as measured by the FTSE Canada Universe Bond Index and Bloomberg US Aggregate Bond Index, rose by 4.3% and 4.7% (USD), respectively, over the same period.** This was driven by slower global growth and interest rate declines.

Despite some market ups and downs, both stock and bond investors have seen good returns this year. However, many questions lie ahead.

What will economic slowdowns look like globally? Are some economies more vulnerable than others? The global economy, including the U.S. and Canada, may not be as stable as it seems. A mild recession is expected both here and in the U.S.

Is now the time to shift from tech-heavy mega caps to small caps? Nearly 40% of U.S. small-cap companies have reported recent losses or declining profits over the past 12 months.‡ In a slowing economy, with uneven earnings growth and high valuations, it’s wise to focus on high-quality companies and portfolio diversification.

After a strong 3-month stretch for bond returns, how much growth potential is left? Patience and a sound fixed-income strategy are essential to endure over time. Central banks are starting to lower interest rates, which will likely help bond portfolios. Flexibility is key in today’s highly volatile fixed-income markets. The strongest portfolios will be those that can adapt and capitalize on emerging opportunities.

Who will drive near-term returns: the U.S. presidential election winner or the Federal Reserve chair? Market volatility often surprises and can happen when investors feel most secure. Recession risks, Federal Reserve actions, the U.S. election, and general market sentiment could all cause further volatility. We believe it is important to stay calm and wait for the right moment to act on opportunities, rather than letting fear drive their decisions.

Navigating a noisy autumn

Despite potential short-term challenges, the market outlook remains favourable for longer-term investors. Over the coming year, global central banks are expected to continue cutting interest rates, creating a supportive environment for both stocks and bonds. Maintaining a balanced and diversified portfolio is central to managing the months ahead.

*Source: Bloomberg. As at September 30, 2024.

**Source: Bloomberg. As at September 30, 2024.

‡Source: Bloomberg.

What is a Trusted Contact Person and Why is it Important to You?

Frank Valicek, CFP, CIM

Senior Financial Advisor, Manulife Wealth Inc.

President & Life Insurance Advisor, Upper Canada Capital Inc.

A Trusted Contact Person (TCP) is a mature individual that you designate who can help us protect your financial wellbeing. It’s someone that you allow us as your advisors to reach out to if we’ve been unsuccessful in contacting you or are concerned you are being financially exploited or are making poor decisions because of diminished mental capacity. For example, we may notice transactions or financial decisions that are unusual based on your past behaviour and ask the TCP to provide your Power of Attorney’s contact information.

Do you have to have a TCP?

We as your advisor are required to ask you if you’d like to name a TCP, and to make note of your decision. We recommend that you do so since we are often in the best position to see changes in your financial behaviour. With a TCP, we have someone to contact who has your best interests at heart.

How is a TCP different from a POA?

A TCP is not the same as a power of attorney. A power of attorney (POA) gives someone else the authority to make financial decisions for you, either right away or if you become incapacitated. A TCP does not and will never have this authority. However, a TCP is someone else we can reach out to, other than a POA, if we have concerns.

Who can be a TCP?

A TCP should be a trusted adult with no financial interest in your accounts. Typically, this is a close friend, family member or caregiver.

How do you set up a TCP?

All that’s required is a simple one-page form with your TCP’s contact information that allows us as your advisor to share limited information with them. You have full control and can change your TCP at any time.

Next Steps

Once you have a potential TCP in mind, think about how they’d react if your advisor called to discuss concerns about your recent financial decisions or memory lapses. Would they listen to your advisor with an open mind? Just as important, would you hear them out if they raised those concerns with you? Share the above information with your potential TCP so they understand exactly what the role is and is not. For example, it is an opportunity to help protect you if you become financially vulnerable. It is not a licence to make decisions for you or to take away your control over your own financial affairs. From our perspective as your advisor, it’s also not authority to share information with the TCP about your financial accounts.

Naming a TCP is one of the ways you can provide an additional safeguard for your money and it’s an important part of good financial planning.

Year-End Registered Retirement Income Funds (RRIF) Withdrawals and RRIF Conversions for Clients Turning Age 71

Ryan Chan, CFP

Financial Advisor Associate, Manulife Wealth Inc.

As the calendar year is coming close to the end, clients turning 71 this year face important decisions regarding their Registered Retirement Income Funds (RRIFs). This milestone age brings significant changes in retirement planning, particularly for those who have accumulated savings in Registered Retirement Savings Plans (RRSPs). We have prepared a comprehensive guide on understanding RRIF withdrawals and conversions as you approach or have reached this pivotal age.

Understanding Registered Retirement Income Funds

A RRIF is a tax-advantaged investment account designed to provide retirees with a steady income stream throughout retirement. Unlike RRSPs, which are primarily used for accumulation of savings during one’s working years, RRIFs facilitate the withdrawal phase, allowing individuals to withdraw funds for their living expenses in retirement.

Mandatory Conversion at Age 71

By the end of the calendar year in which you turn 71, you are required to convert your RRSP into a RRIF or another retirement income option, such as an annuity. We are currently reaching out to all our clients that have RRSP accounts that are eligible to convert to RRIF accounts this year.

Understanding Minimum Withdrawals

Once your RRSP is converted to a RRIF, you must begin making minimum withdrawals each year. The minimum amount is based on your age and the total value of the RRIF as of December 31st of the previous year. For someone at the age of 71, the minimum withdrawal rate is 5.28% of the RRIF balance, which means if your RRIF has a year-end balance of $100,000, you would need to withdraw at least $5,280 the following year. The withdrawal rate increases with each year.

RRIF withdrawals can be set up as a lump sum at any time during the year or they can be set up as a systematic withdrawal plan monthly for ongoing cash flow needs in retirement.

There is also the option to base your minimum withdrawal on your spouse’s age if they are younger to set up smaller minimum withdrawals each year. A minimum RRIF withdrawal is not required in the year of conversion.

Important Considerations:

Tax Implications: Withdrawals from a RRIF are considered taxable income. It’s essential to plan your withdrawals carefully to manage your tax liability effectively.

Flexibility in Withdrawals: While you must withdraw the minimum amount, you can take more if you need additional funds. An important point to remember is that any amounts withdrawn above the minimum withdrawal rate will be subject to withholding tax.

Final Thoughts

As the year ends, consider the timing of your RRIF withdrawals. If you haven’t made any withdrawals yet this year, ensure you meet the minimum withdrawal requirement before December 31st. This will help avoid penalties and ensure compliance with tax regulations. We will be reaching out to all clients with RRIFs to ensure that the minimum payments are set up for withdrawal.

Understanding the Difference Between a Beneficiary and a Successor Holder for Your TFSA

Jordan Pereira, B.Com (Hons)

Financial Advisor Associate, Manulife Wealth Inc.

When it comes to managing your Tax-Free Savings Account (TFSA), it’s essential to understand the implications of naming a beneficiary or a successor holder. Both roles play crucial parts in the management of your TFSA after your passing, but they have distinct differences that can affect your financial planning and your loved ones’ inheritance.

What is a Beneficiary?

A beneficiary is an individual or entity designated to receive the assets of your TFSA upon your death. Here are key points to consider:

- Transfer of Assets: When you name a beneficiary, the assets in your TFSA will be transferred to them directly upon your death. This process bypasses applicable provincial probate, making it a quicker way for your loved ones to access the funds while not incurring the probate fees.

- Tax Implications: The transfer of TFSA assets to a beneficiary is generally tax-free. However, it’s important to note that any growth in the account after your passing may be taxable if the beneficiary is not your spouse or common-law partner.

What is a Successor Holder?

A successor holder, on the other hand, is a specific role typically designated for a spouse or common-law partner. This designation comes with distinct advantages:

- Continuity of the Account: If you name your spouse as a successor holder, they can assume ownership of the TFSA upon your death. This means the account continues to exist without disruption, keeping the tax free status, while not impacting the Successor Holder’s personal TFSA contribution limit.

- Tax Benefits: Similar to beneficiaries, the transfer of assets to a successor holder is tax-free. However, unlike beneficiaries, the successor holder retains the tax-free status of the account, and any contribution room is preserved.

Key Considerations

When deciding whether to designate a beneficiary or a successor holder, consider the following:

- Relationship Dynamics: Your choice may depend on your relationship with potential beneficiaries or successor holders. If your spouse or partner is involved in your financial decisions, naming them as a successor holder might be ideal.

- Financial Goals: Think about how you want your TFSA assets to be used after your passing. A beneficiary may have different priorities compared to a successor holder.

Conclusion

Understanding the difference between a beneficiary and a successor holder for your TFSA is vital for effective estate planning. Each option has its benefits and implications, and the right choice depends on your specific financial situation and goals. By making an informed decision, you can ensure that your loved ones are well taken care of and that your financial legacy is preserved according to your wishes.

Investing at All-Time Highs

Stephen Choi, BBA, BA

Marketing Assistant, Manulife Wealth Inc.

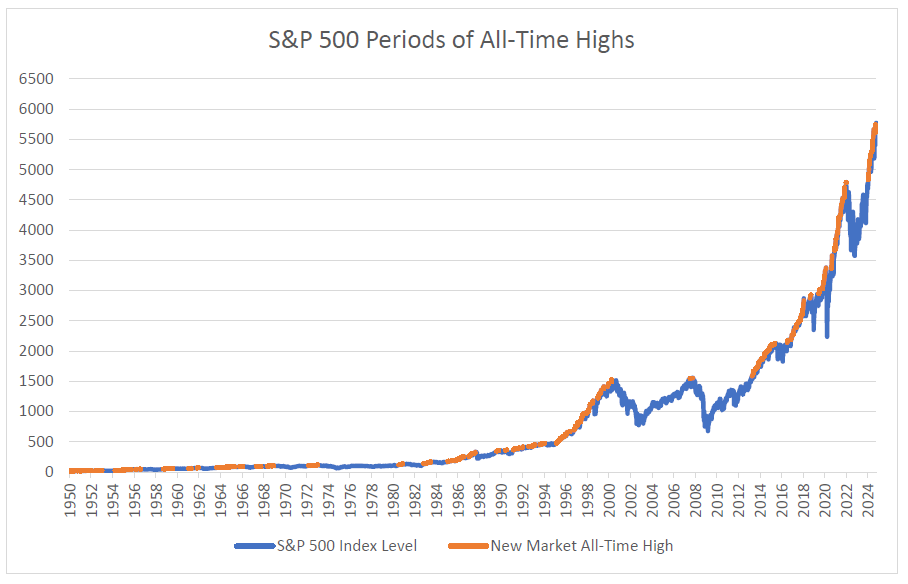

Investors never enjoy seeing the stock market decline, but they may also hesitate to invest when the market is at an all-time high. Rightfully so, investing at market highs means paying the highest price for a stock than everyone before you.

After all, the financial media is always pushing the mantra “Buy low, sell high” leading investors to try their hand at timing the market, with usually little-to-no success. All-time highs in the market are common and there have been many long-running market booms that would keep you on the sidelines for years at a time if you waited for market lows.

Since the 1950s, the S&P 500 Index, which measures the broad U.S. stock market, has seen 1,499 days where the market has reached all-time highs. On an average year in the market, you would expect to see just over 20 all-time highs. What this tells us is that market highs are relatively common, and stocks tend to move higher over the long term. Short-term market fluctuations should not dictate long-term investment decisions.

Source: YCharts on 10/9/2024; The S&P 500 Index tracks the performance of 500 of the largest publicly traded companies in the United States. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Disclosures

This message is only to be read by the addressee and is not for public distribution. The sender is not responsible for distribution of this message beyond the addressee intended. All information in this message is confidential to the addressee and should be treated as such.

Upper Canada Capital is a trade name used to carry on business related to life insurance and stocks, bonds and mutual funds. Investment dealer dealing representatives (“Investment advisors”) registered with Manulife Wealth Inc. offer stocks, bonds and mutual funds. Insurance products and services are offered through Upper Canada Capital Inc. and Manulife Wealth Insurance Services Inc. Banking products and services are offered by referral arrangements through our related company Manulife Bank of Canada. Additional disclosure information will be provided upon referral. Please confirm with your Advisor which company you are dealing with for each of your products and services.

This is not an official publication of Manulife Wealth. The views, opinions and recommendations contained in this publication are those solely of the author and this publication does not express the views, opinions or recommendations of Manulife Wealth. This publication is not an offer to sell, or a solicitation of an offer to buy, any securities. This publication is not meant to provide legal, accounting, account or other advice. As each situation is different, you should seek advice based on your specific circumstances. Please call to arrange for an appointment. Manulife Wealth makes no representation or warranty, express or implied, as to the accuracy, completeness or correctness of the information contained in this publication.

The Advisor and Manulife Wealth and Manulife Wealth Insurance Services Inc. (“Manulife Wealth”) do not make any representation that the information in any linked site and/or 3rd party articles is accurate and will not accept any responsibility or liability for any inaccuracies in the information not maintained by them, such as 3rd party articles and/or linked sites. Any opinion or advice expressed in a 3rd party article and/or linked site should not be construed as the opinion or advice of the advisor or Manulife Wealth. The information in this communication is subject to change without notice.

Investing involves risks, including the potential loss of principal. Financial markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. This material was prepared solely for informational purposes and does not take into account the suitability, investment objectives, financial situation, or particular needs of any specific person.

All overviews and commentary are intended to be general in nature and for current interest. While helpful, these overviews are no substitute for professional tax, investment or legal advice. Manulife Wealth Inc. and/or Manulife Wealth Insurance Services Inc. (“Manulife Wealth”) makes no representation or warranty, express or implied, as to the accuracy, completeness or correctness of the information contained in this publication.

This publication does not constitute a recommendation, professional advice, an offer or an invitation by or on behalf of Manulife Wealth to any person to buy or sell any security or adopt any investment approach. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification or asset allocation doesn’t guarantee a profit or protect against the risk of loss in any market. Past performance does not guarantee future results.

This material is intended for the exclusive use of recipients in jurisdictions who are allowed to receive the material under their applicable law. The opinions expressed are those of the author(s) and are subject to change without notice. Our investment teams may hold different views and make different investment decisions. These opinions may not necessarily reflect the views of Manulife Wealth. The information and/or analysis contained in this material has been compiled or arrived at from sources believed to be reliable, but Manulife Wealth does not make any representation as to their accuracy, correctness, usefulness, or completeness and does not accept liability for any loss arising from the use of the information and/or analysis contained.

The information in this material may contain projections or other forward-looking statements regarding future events, targets, management discipline, or other expectations, and is only current as of the date indicated. The information in this document, including statements concerning financial market trends, are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Manulife Wealth disclaims any responsibility to update such information.

Manulife Wealth shall not assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained here. As each situation is different, you should seek advice based on your specific circumstances. Please call to arrange for an appointment.

Copyright 2024 by Upper Canada Capital.

Manulife, Manulife & Stylized M Design, Stylized M Design and Manulife Wealth are trademarks of The Manufacturers Life Insurance Company and are used by it, and by its affiliates, under license.