learn more about the steps in financial planning

We are very proud of the thought and planning that has gone into building the financial planning and investment management practice that you have always wanted.

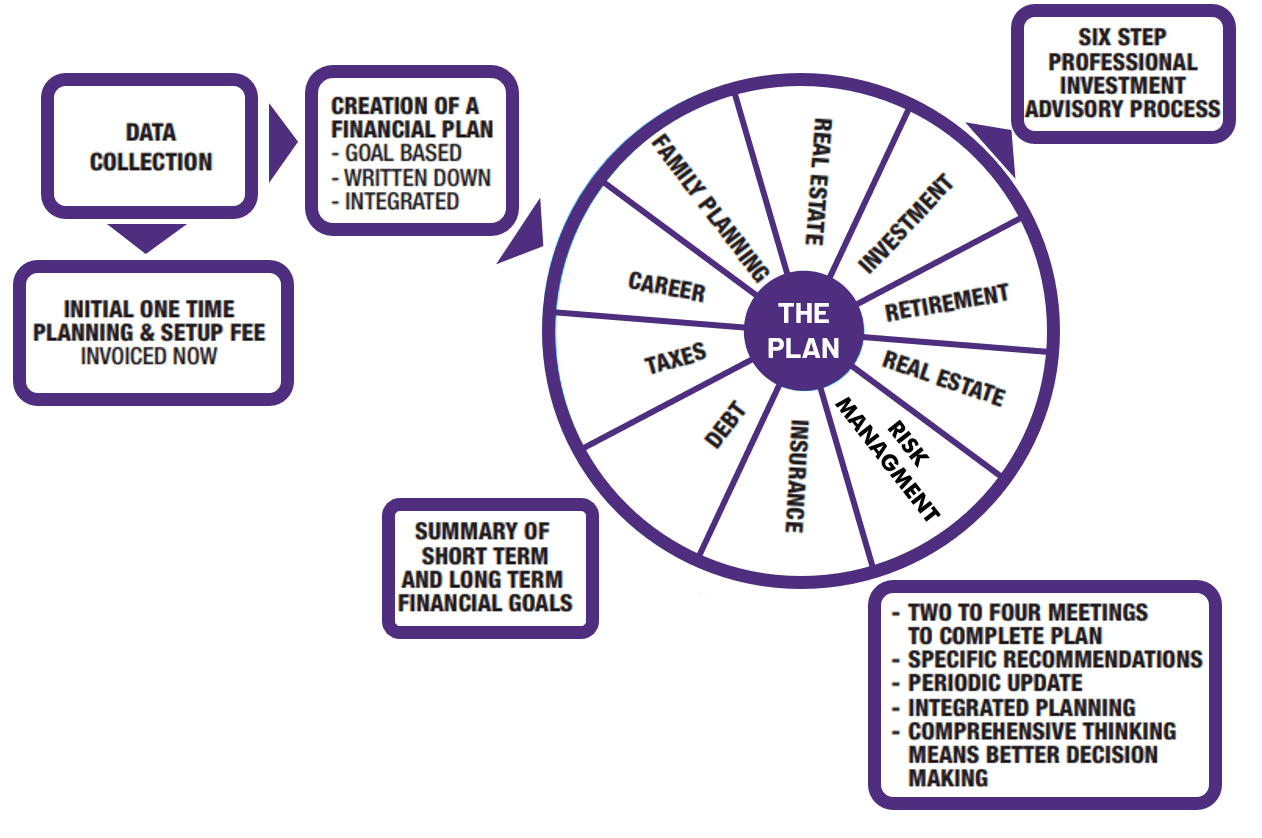

The chart below describes in a detailed visual format of the financial advisor process. How we work with you to define your goals, identify the financial planning topics you need help with, outline our investment management process, explain how we will communicate with you and our approach to fees.

Our commitment to quality and how we care about your goals is shown in our unmatched attention to detail and methodical approach to your finances.

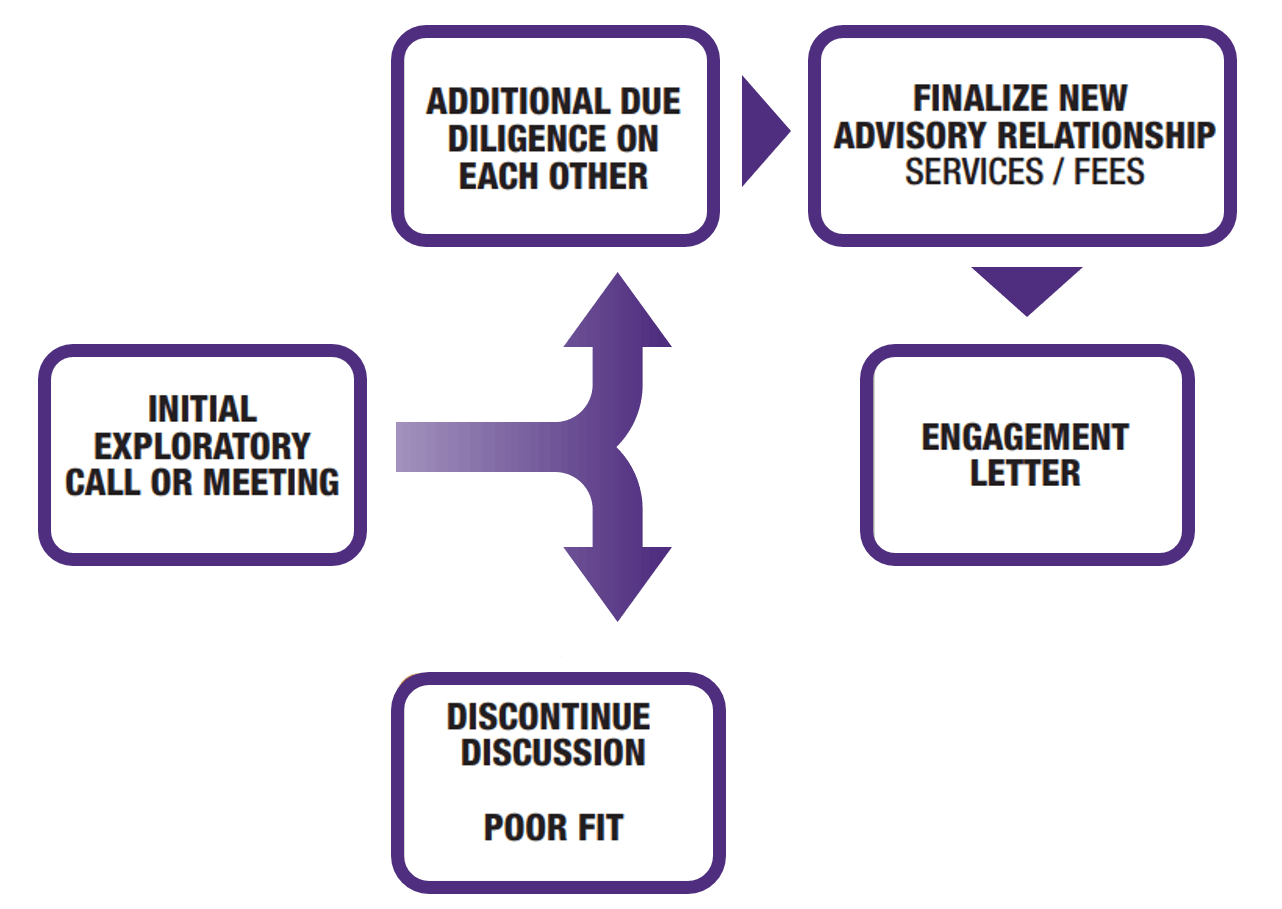

Initially, we will meet with you or schedule a call to introduce ourselves, learn about you and introduce you to our services. This first contact is complimentary and will determine if there is a fit between your needs and wants and our service standards.

If we agree to work together, we will send you an engagement letter that outlines the services and fees. An engagement letter is our symbol of accountability, focus and transparency.

Over several meetings, we will identify areas of your finances that need to be dealt with and tackle each topic on a prioritized basis. Whether we build your RRSP portfolio, review your life insurance coverage, prepare a retirement plan or help get your Will prepared. All of our advice will be integrated with all other planning areas and based on your goals.

Our “big picture” approach to the financial planning process links all of your planning areas together to give you a sound, cohesive approach to your finances.

We believe you need a financial plan and your financial goals defined before we deal with your investments. Our investment advisory process is a six-step process that integrates your goals and your financial plan with your risk profile.

We are able to offer a wide variety of investment products from around the world and we will work with you to build a portfolio that is tax-smart, value priced and risk managed.

Once the portfolio has been completed, we will stay in the picture to monitor products and report to you. Lastly, as you age and change we will adapt the plan to reflect your changing needs.

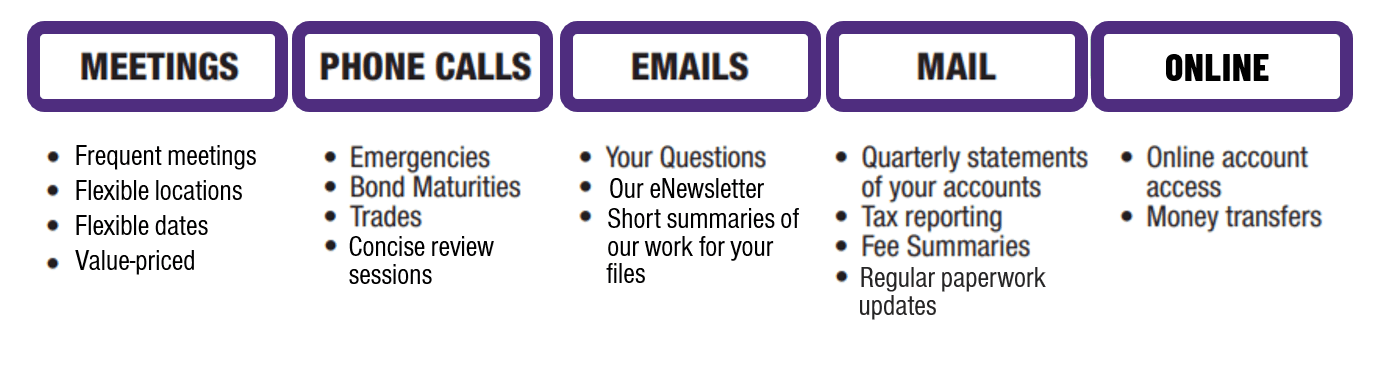

We have customized our communication approach to give clients what they want and when they want it. We work with you to offer meetings, calls, emails and more on a basis you prefer. This can include meetings at your home, communication several times a year and detailed analysis sent to your phone.

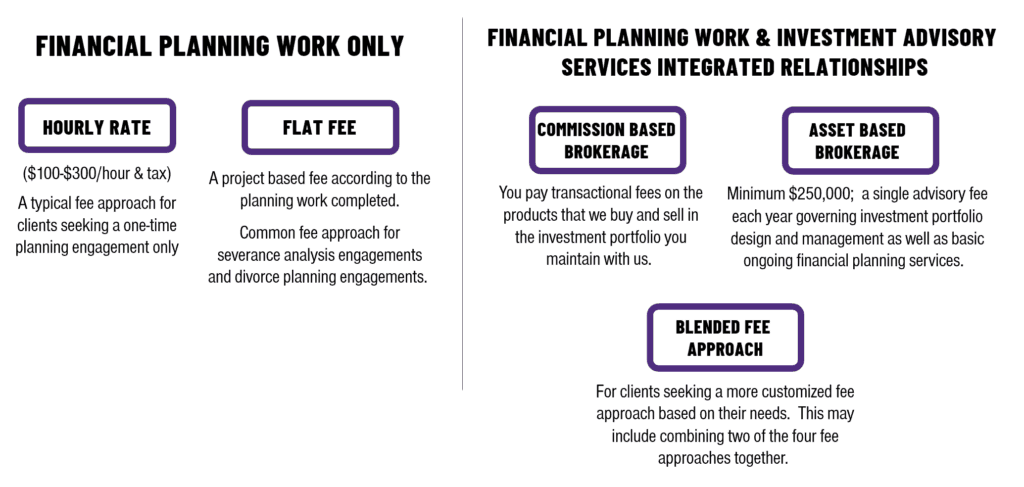

We may be the only wealth management practice in Canada that offers five fee options. That’s because we believe everyone is different and we are committed to finding the right value proposition for you.

We will review all five fee options with you each year to determine whether the current approach continues to be best for you.

As you age, change or face life events like retirement, health issues and more it is imperative that we keep your financial plan and investment portfolio up to date. We will always stay in touch with you, offering meetings, calls and more to understand what is new and to brief you on results.

By signing up to receive Kurt’s enewsletter you give explicit permission for Kurt or Kurt’s staff to email you to deliver this enewsletter.

2848 Bloor Street West, Etobicoke, Ontario

M8X 1A9 Canada

+1 416-628-5761 ext. 0

Monday | 8:30am–5:30pm |

Tuesday | 8:30am–5:30pm |

Wednesday | 8:30am–5:30pm |

Thursday | 8:30am–5:30pm |

Friday | 8:30am–5:30pm |

Saturday | CLOSED |

Sunday | CLOSED |

Save money and build reliable wealth with the strategies Kurt gives to his clients. Fill out your email to get access to the document!

Your privacy is fully protected. By signing up to receive Kurt’s Wealth Building Strategies you give explicit permission for Kurt or Kurt’s staff to email you to deliver his enewsletter.

Click the link below, or check your email to get access to Kurt’s Top 12 Wealth Building strategies. Check it out to view the essential tips he gives to all his clients!