How to choose a financial advisor

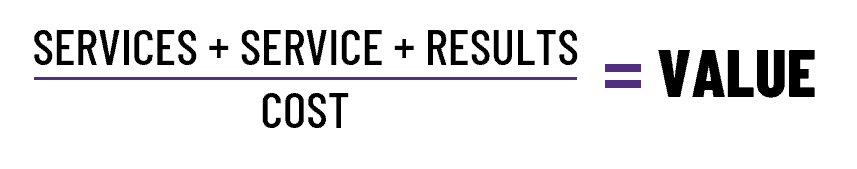

want to know what makes a good financial advisor? the key factor is value

Guiding You To Your Goals

In many situations a family advisor can help you to eliminate costs from your investments, and your taxes such that the fees are not incremental. In some situations with clients who invest in mutual funds, Kurt has been able to reduce their total investment costs including fees, so that overall they are paying less but now have a professional personal CFO as their lifelong advisor! Now that’s value.

Why Choose Kurt?

Real Knowledge and Experience

Kurt's academic background and work experience may be unparalleled in Canada among retail financial advisors.

Kurt is not a salesperson, but rather a professional financial advisor capable of delivering true expertise and value over your personal finances. For greater validation of this point, read a handful of the articles Kurt has written – his backlog of eNewsletters are available online. From taxes to investing, estate and retirement, Kurt offers a deep technical expertise for guiding your financial affairs far beyond what stock or fund you need.

Centralized Approach

Overall personal CFO to provide an integrated approach.

Are you left trying to piece it all together? Kurt Rosentreter acts as your overall personal CFO

(Chief Financial Officer) to provide an integrated approach between the different areas of your finances (investing, estate, taxes, retirement, etc.) saving you time and money – and most importantly, leading to better decision making. Kurt offers a strong expertise in all of the basic areas of your personal finances, able to cross-plan different areas of your finances and integrate goals and resources. This can be more effective than having four different advisors who rarely or never talk to each other about your needs.

Accessible

So many Canadians have a wide variety of accountants, brokers, financial planners, insurance agents and more that they utilize for financial advice. But with so many separate "silos" of advisors, do you really have an overall game plan?

Kurt is looking for enjoyable client relationships at all wealth levels. Better still: fees offered are extremely reasonable and value-based. Inquire about a free estimate of what it would cost to work with you. Even if you are a do-it-yourselfer. You may be very surprised!

Close Working Relationship

Kurt has a limited number of clients and always will. While many advisors have 2,000 or more clients, Kurt has less than 300.

With only 200 working days in the year for all of us, Kurt likes to maintain regular and strong contact with clients. In his opinion, this is only possible with a smaller client base. Clients love the ease of contact, the fast responses and the frequent communication.

Actionable Information

Many clients enjoy the advanced investment reports that Kurt can generate on their investment portfolios.

Investment statements can show portfolio rate of return and can also show rate of return for individual investments. And these statistics can be generated any day of the week! Finally, meaningful information to help you understand how you are doing.

Business Owner

Kurt is a business owner who cares passionately about his business and his reputation of quality.

Manulife Securities is an investment dealer without in-house restrictive proprietary products so you are guaranteed 100% objective advice. Manulife allows Kurt to provide a wide variety of services to his clients, offer a variety of fee choices and generally leaves Kurt to assist his clients in the best way possible. This is unlike many investment dealers in Canada. In selecting Manulife as the dealer to team up with, Kurt selected a strong independent partner with similar goals and a commitment to excellence and objectivity.

Wide Range of Options

Mutual funds are not right for everyone.

Kurt is able to offer the world of investment products, including stocks, bonds, income trusts, GICs and more. Kurt believes that you should not be restricted by choice – ask your current financial advisor if he/she can offer this broad range directly (not through a third party intermediary).

He Comes to You

We are aware and respect the busy lives our clients lead.

Kurt visits many of his clients in their homes…as far away as Niagara Falls and Winnipeg. For older clients and for busy executives, Kurt conducts meetings in offices and homes to accommodate your preferences.

Works to Achieve Your Goals

All of Kurt's advice is goal driven. No hot tips, no product pitches or flavours of the day.

All advice that Kurt provides is built around you achieving short term and long term goals. Products are only tools that can help to achieve some goals – when they are needed they are only discussed well into Kurt’s advisory process. Together with Kurt you will build a logical financial plan founded on common sense. You cannot buy a product until you know what you need.

Variety of Fee Structures

Kurt offers five different fee approaches.

You can engage Kurt for services and pay an hourly rate fee. Or you can pay an annual flat fee. And you also have the traditional choice of paying commissions and having Kurt manage your investments. You should also explore asset based fees and their superior tax deductibility. The bottom line is that Kurt offers five different fee approaches ensuring a comfort level for everyone.