When it comes to financial planning for your children, we want to do things the right way. To take care of our children financially when they are young and dependent, guide them as young adults, and transfer our wealth to them when we die in old age and they often have children of their own.

Children. One child. Five children. Grandchildren. Young children. Adult children.

When it comes to planning, the bigger your family and the more complex your net worth, the more financial planning issues you have, let’s examine some of the most important planning issues in Canada related to your family at each age range.

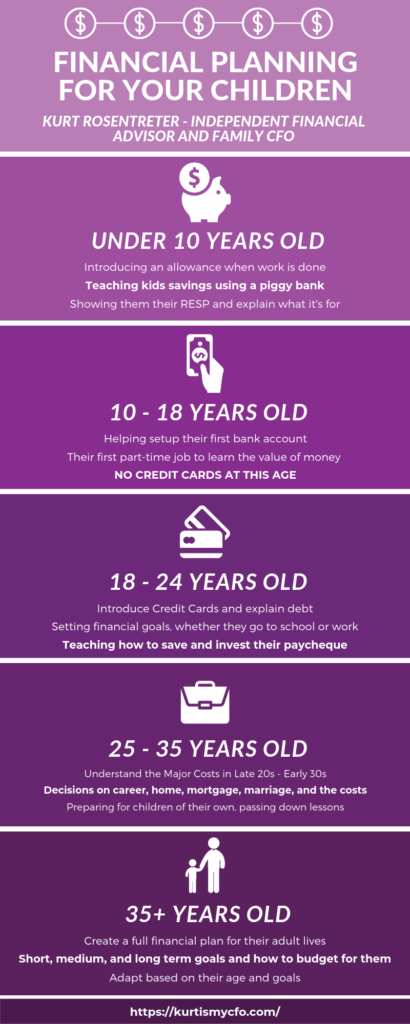

Under 10 Years Old – Explaining Money to Kids

At these formative young years, it is an excellent time to introduce the concept of money and the role it plays in society. Up to this point, kids may think that everything is free and easy – there are several steps you can take to start to teach about our financial system.

How to Give Your Children Allowance the Right Way

The traditional allowance – don’t just give the child money every week or month. Make a trade-off the funds for completion of a task like making a bed, picking up clothes or setting the table. Explain that this aspect of barter (work for money) is the fundamental element of our society.

Teaching Kids Savings at An Early Age

Keep a proverbial piggy bank on their dresser in the bedroom. Have them count what is inside regularly and the impact of using the money to buy something – have them count again to teach that there is a limited aspect to cash.

If the piggy bank is empty, show them that they cannot afford to buy anything.

When going to the bank, let children stand in front of you at the Instant Teller machine at your financial institution. Let them push the buttons, pull out the cash, get the receipt and at the same time discuss what is happening.

Use the bank as a central focal point for accumulating their money and tell them how our financial institutions serve the same purpose for parents’ money.

RESP Planning for Your Kids

When your child was born, you may have opened an RESP (Registered Educational Savings Plan) which is a government-sponsored savings program where you get a 20% grant for every dollar you deposit up to defined limits.

As your child gets close to ten years old, they are old enough for financial discussions. Answering questions about what an RESP is, what post-secondary education is, how the money should grow, and why you make contributions.

At this age they are at the very early stages of learning that there can be school after high school, and talk about RESPs helps to introduce the idea that you need to save for more school in advance.

10 To 18 Years Old – Teaching Children About Money

Children this age are starting to have a mind of their own, maybe earning money from babysitting or paper delivery, and want to buy clothes, games, and more. They are now young consumers, and their financial education should take on a higher level of sophistication.

Setting Up Your Child’s First Bank Account

Set up a child’s savings account at a local financial institution, obtain a debit card for the child if you can and set up to receive a paper statement (at least for a while).

Take your fourteen-year-old to the institution to deposit earnings and to make withdrawals, taking the opportunity to explain the purpose of a financial institution.

Explaining Taxes to Your Kids the Right Way

A teenager with earned income from a job also means you can file a tax return for them. They will not pay any income tax unless they earn more than $10,000 a year but filing a tax return regardless starts them receiving RRSP contribution room.

They can open an RRSP at age 18 and a lump-sum contribution made at that point.

The filing of a tax return presents a new opportunity to discuss the concept of taxes with your teenager. Teaching how a tax return is a once a year summary of how a portion of your earnings are sent away to provide a variety of services for society (I’m sure you will find your way to say this!).

Introducing Financial Education to Children

At this age, often kids in school also start to do projects on business topics. Reading the newspaper or watching the news together with children presents ample opportunity for you to start talking to them about governments, business, currency, trade, corporations, economics and a host of other topics related to understanding necessary finances.

If you do this, and you are providing a solid base of financial education that will go beyond what many schools offer, putting them way ahead of the curve.

Teaching Kids the Value of Money

For children growing up with affluent lifestyles, these are formative years for understanding the value of money. Often children get anything they want in a wealthy household, grow up with the nicest of everything and can have little appreciation for hard work or for the challenges of getting money if you don’t have it.

I have had to assist many children in their 20s and 30s to re-align their financial goals now that they are out on their own and without their parent’s money at their fingertips. Finding out that mega vacations, expensive foreign cars and big houses are now a thing of the past as they struggle to live on their own “normal-level” Canadian incomes.

Often the kids are in shock. You can avoid this – when they are ten to fifteen years old incorporate some hard life lessons with money and your kids – don’t hand them everything they want every day, rethink lavish and endless gifts and designer clothes.

Please encourage them to get part-time jobs and remove all allowances at this age. Giving them this equivalent experience will set them well for their 20s and 30s.

No Credit Cards for Your Kids at This Age

Our recommendation at this stage is no credit card exposure for kids up to this point. When it comes to teaching financial planning to your children, I see no value in teaching kids about using other people’s money and spending beyond your means. Please give them a debit card instead and teach them how spending their own money will reduce their account balance until there is no money left.

Introducing Your Kids to Your Financial Advisor

This age is where I encourage parents to bring their children to meetings with me, the financial advisor.

First, they can learn that sometimes individuals and families look to an advisory partner to help them with their finances – whether it be for expertise, objectivity, integrated planning or to simplify their own lives –all for a fee. This exposure is often a person’s first introduction to professional service providers (e.g. lawyers, accountants, and more).

Second, for a teenager with some money, we will often open an in-trust for the account and start a small investment account that we can manage and monitor with them. We will buy a share or two in a company they can relate to – Apple, Sony, Disney, Royal Bank or others. We will also encourage purchasing a bond, a GIC, a mutual fund and other securities.

This opportunity is where they can learn about different products and how they interact with the marketplace. The child will get a paper statement mailed to their home, and they are encouraged to communicate with us by email or other means to ask questions about their account, the products and how it all works.

Often, because we are neutral from mom and dad, the relationship flourishes and much financial knowledge is absorbed quickly by the young kids.

18 – 24 Years Old – Teach Your Child Financial Responsibility

This age range is a critical time for teaching financial planning to your children. They are typically in post-secondary education (university, college, trade school or other) or went directly into the workforce after high school. Children have very different goals depending on their paths at this stage, and we advise them as such.

While they may still look to dad or mom for advice on money matters, they may also rebel against parental guidance which can be viewed as “bossy” or “I know better.”

At this stage more than most, as they gain their independence, working with their advisor and starting to feel like their own person. We treat these young adults as individual clients (not the son or daughter of our client) and make them feel important.

For the parent, losing this control can be uncomfortable. At the same time, you know we are their new advisory partner, and we are guiding your children the way we guide you – they are in good hands.

Introducing Credit Cards for Your Children

This stage is often the first point where children get credit cards, so we start to talk about cash flow budgeting, how a credit card works and the importance of not carrying balances month to month.

We find that if we get involved early enough, we can teach fundamentals that avoid bad credit habits later – we have already had to help a few 20 somethings go through bankruptcy and credit counselling due to credit card bills they could not pay off.

We can avoid this if the parents teach proper financial accountability, spending control and money management at a young enough age. If the parent doesn’t do it, we will start the lessons as soon as we are introduced to the children.

Setting Financial Goals When Your Children Go to School

For the student, we start to talk about their financial goals later in life – do you think you will want to own a home, have a family, travel and so on. We help them to put prices on these goals and have drastically affected their career directions from this analysis.

We continue the investing relationship with the student that we started a few years back – routinely talking about investment results in their account. After age 18 their parent’s name often comes off the in trust for an account, but we still encourage the child to continue to let their parents get a statement cc’d copy in the mail each quarter. We routinely do investment update conference calls with kids in their dorm rooms on campus.

Setting Financial Goals When Your Children Go to Work

When doing financial planning for children just out of high school, we will also start with goals, but clearly, they are different – perhaps buy a home in the next five years, get a vehicle, enjoy life with regular vacations, and spend money on things they like.

At this young age, often long-term goals are far from their minds. We try to instill balanced thinking with their paycheque. Knowing these kids may spend every dollar they make; we encourage opening several investment accounts with us and setting up automatic transfers from their paycheque account to these accounts for various amounts.

One account may be saved for a car. Another account maybe for a home purchase deposit. Another account as an emergency fund, and so on.

We get them thinking about how to compartmentalize their money, and how to allocate some of it towards a variety of goals. Without this coaching, a child will end up getting it backwards – spending most of their paycheque on lifestyle and then struggling to find the money for RRSP, disability insurance, an emergency fund and other important financial goals.

Teaching Kids What to Do with Their Paycheque

Also, now that they have a paycheque, they are paying taxes, and they are accruing RRSP contribution room. We encourage them to open two investment accounts: a Tax-Free savings account to save $5000 over a few years for emergencies. We hold this money in a high-interest savings product for easy access.

Moreover, we encourage them to open a basic RRSP account and may automate monthly contributions from their chequing account. With forty years of compounding time inside an RRSP portfolio, they have a higher likelihood of achieving their retirement goals by starting early.

25 – 35 Years Old – Help Your Kids Achieve Financial Independence

By this age, most children in Canada live away from their parents, have careers and perhaps steady relationships. Children still living at home may be saving money, but they are not being taught about financial independence.

This age is one of the most complicated and essential stages of their finances in their entire lives.

Understanding the Major Costs in Late 20s To Early 30s

Within ten years starting around age 25, most children will:

- Finalize a career that they hope lasts for forty years

- Buy a home (often the most expensive assets a person will ever buy)

- Agree to a mortgage (the most substantial debt they will ever hold)

- Get married to a stranger and hope it lasts half a century

- Have children of their own – with a financial cost that could easily exceed a million dollars per child over their lifetime.

The correct financial planning for children at this stage can make or break their future.

Sadly, most twenty-somethings do not seek out financial guidance or get turned off by financial advisors that brush them aside because of little or no portfolio wealth yet.

Specifically, for people in this phase, here are some planning areas they may need guidance on.

Starting A New Career

Helping them to decide on choices in their group benefits package and their pension plan; understanding what company stock and stock options are; financial programs for bonuses and how taxes work with company cars and other perks.

Cash Flow Management

This phase is where we like to see kids get serious about cash flow management and following their goals. It is time for the child (and their spouse) to assess if they are spenders or savers – it’s dangerous if you have one of both.

They may also need cash flow templates to follow concerning preparing annual budgets – less about day to day cash flow needs and more about strategic purchases like homes, cars, vacations, renovations, debt elimination and more.

Often at this age a financial planner will monitor progress towards these goals more than may be necessary with older people – after all, the child is new at this, maybe new to managing finances with a new partner/spouse, and we want to see if good habits or bad habits take root in their investments. By staying involved a financial planner can coach them along the way to become good financial stewards.

Getting A Vehicle

It is essential to examine the three methods to purchase a car: leases, loans and buying one outright. It is also necessary to evaluate if a family can afford two cars and what kind.

Buying A Home

Proper financial analysis is necessary to determine what they can afford to spend on a home, types of mortgages, payment size, interest rate decisions and even set up the mortgages for them.

In Canada today, too many young people have rushed headfirst into big mortgages and find themselves with little cash flow for other things – beware – know what you can afford!

Creating An Investment Plan And RRSP

Whether through an employer’s group plan or an individual RRSP or Tax-Free account, setting up a monthly savings plan is an effective way to start investing for the long term.

There are many different types of products to buy. To learn about investing, consider purchasing a variety of securities in the form of a balanced portfolio of fixed income and risky assets that matches the new investor’s risk profile. Studying different securities in their accounts allows them to learn about different investing styles, fees, risk, returns, diversification, products, costs and more.

Estate Planning and Insurance

One area of estate planning important for young people to address is a Power of Attorney form – this important form ensures the family can manage their affairs if they become incapable of doing so.

Similarly, with personal insurance, evaluate what they get in their group benefits plan at work and consider a top-up enhancer plan for disability insurance to give them a better safety net should they be unable to work for an extended period.

If the person has a mortgage and a family at this stage, disability insurance which protects their working life of income generation is essential.

Financial Planning with A Spouse

Lastly, a child who marries or takes a life partner in this phase can often cause issues about how the finances will fit together.

Children come with questions like merging our bank accounts, who will pay bills, should one person only be in charge of the finances, do we need a will, RRSP and life insurance beneficiary designations and who’s name to save in.

As a neutral third party with ample advisory experience with couples, we can tell them what works best in combining a new couple’s finances.

Financial Planning for When Your Kids Have Kids

How does financial planning for your children work when they have children of their own? In Canada today people are having kids later in life – often after age 30 once careers are established.

There are three significant financial planning areas to address when a baby is on the way:

Life Insurance

Completing a proper needs analysis takes about two hours with the individual and couple and should be completed at least six months before the baby is born.

Review the types of life insurance (term and permanent), how much one needs to have (up to 20x your annual income in some cases), how long to carry the insurance (20 years or more), how employer group insurance fits in (it doesn’t), why you never should buy bank life insurance on your mortgage and much more.

Review how much life insurance you need on a stay at home spouse, how your life, disability and critical illness insurance needs should evolve over your lifetime and which insurance companies to avoid.

Wills and Estate Planning

When a baby is on the way, now is the time to get serious about estate planning. Protecting a new dependent child is critical to ensure they don’t end up in foster care managed by the government.

Everyone needs at least two estate documents (will and Power of Attorney for finances) and perhaps a third document (Power of Attorney for healthcare) depending on your beliefs.

In this estate planning discussion before you head to the lawyer, a financial planner will discuss the right choices for Executors, Guardians and Trustees of your estate – it may not be your brothers and sisters. We look at when a family trust makes sense for legal protection against divorce.

We talk about the ages that are appropriate to release money to children after your death and what to do with high ticket assets like cottages. We cover estate planning for second marriages and much more as you get an earful of proper planning well before you should visit the lawyer.

Registered Educational Savings Plan (RESP)

Once the baby is born new parents can complete the social insurance number application to file for a SIN. Once they have a SIN for their child, they can open an RESP with a financial services institution. They can open a self- directed RESPs building an investment plan for children from birth to age 30.

A financial planner can help to calculate how much the parents should save towards future educational goals after age 18 and build an investment plan that matches the child’s timing of need, the parent’s risk tolerances and preferences for investment products.

They will need to examine whether a family plan should be used for multiple children, why grandparents should never own the RESP, why you never, ever use a pooled scholarship RESP and what amount of money is ideal for your annual contribution.

35+ Years Old – Financial Plan for Adulthood

Your children are not children anymore and have now reached adulthood and are immersed in real-life issues of day to day and year by year financial management of their goals. Now with a full life of assets, income, liabilities and expenses ahead of them, the focus shifts to a “financial plan” and proper management of this plan.

While up to now we were tackling age-specific issues suitable to the child’s stage of life, now we switch to the management of the person or family’s full financial plan and the evolution of this plan through their adulthood.

A comprehensive financial plan starts with defining long term financial goals (short term (under 5 years), medium-term (5-15 years) and long term (15 years+), looks at cash flow management of paycheques (budgeting) and explores strategies and solutions in the planning areas of retirement, estate, insurance, real estate, debt, career, children, taxes, legal, investing and more.

From this point on with the family, it is wise to monitor progress of results over time (e.g. achieving net worth growth of 10%+ a year during your working years, debt-free date, retirement capital needs, and more) and adapt the financial plan as the people age, as goals changes and as financial results occur.

We have only scratched the surface on the discussion of a variety of financial planning issues related to children of all ages. As always, we are ready to assist you with questions and real situations that you need advice on.

How a Financial Advisor Can Help:

Our whole team is passionate about helping your children learn about personal finance. In Canada, very little is taught in high school about personal finance, so we have stepped in to fill the gap for our clients!

A few years ago, we launched Money, Skills, and Trading and we offer a curriculum to teach financial planning for children aged sixteen to age thirty or so. Contact the office to get a copy of our Money Skills Training brochure to see what topics we teach about and to learn about next steps if you are interested.

Kurt Rosentreter, CPA, CA, CFP, CLU, TEP, FMA CIMA, FCSI is a national best-selling author seven books on personal finance in Canada and the past co-founder of the national wealth management practice at one of Canada’s “Big Four” public accounting firms. For the last fifteen years Kurt has been a core financial course instructor for the Ontario Chartered Public Accountant Association and also appears regularly in the national press as an expert on matters of money. Kurt is the owner of a national wealth management practice in Toronto working with professionals and business owners on all topics of personal finance. Learn more about Kurt at www.kurtismycfo.com.

Stocks, bonds and mutual funds are offered through Manulife Securities Incorporated. Insurance products and services are offered through Manulife Securities Insurance Inc. Banking products are offered through referral.