Many of us think about life insurance as a product we buy when we have a mortgage or dependents and the insurance payment would provide money during times of catastrophic loss of the person insured. Life insurance protects our loved ones.

But were you aware that another form of life insurance called “permanent life insurance” can work more like a tax-smart investment and offer sizable tax advantages compared to other types of investments?

Permanent life insurance has been around for decades, and the tax benefits are long-established. But the reasons you buy this type of life insurance and who should but it. It’s much different from the regular life insurance purchased to protect your family.

Advantages of Permanent Life Insurance Investment

Tax breaks that are unique to life insurance policies in Canada have been included in the Income Tax Act for many years. But these tax breaks may not be well known to you until now because so few Canadians “fit” the lucrative tax reduction opportunities associated with life insurance.

Here are some of the leading tax breaks and advantages:

Permanent Life Insurance is Tax-Free when Paid Out on Death:

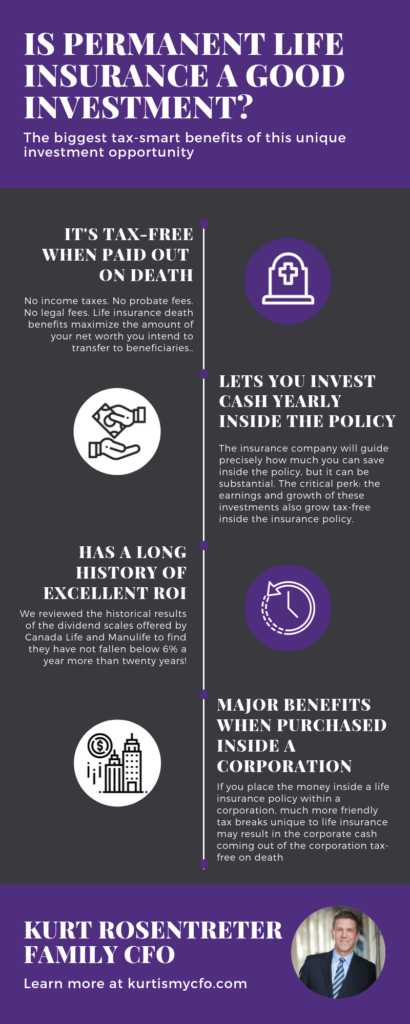

Other than cash, there is arguably no other form of investment that offers such a clean transfer of wealth to heirs. No income taxes. No probate fees. No legal fees. Life insurance death benefits maximize the amount of your net worth you intend to transfer to beneficiaries.

Permanent Life Insurance lets you to Invest Cash yearly inside the policy

The insurance company will guide precisely how much you can save inside the policy, but it can be substantial. The critical perk: the earnings and growth of these investments also grow tax-free inside the insurance policy.

This change means you don’t pay tax every year on the growth of investments inside the policy, so therefore you will accumulate more for your estate. This tax-deferred growth of money you put inside the system coupled with the tax-free payout on death can create a massive transfer of tax-free wealth to your hears that may not be achievable using traditional investments like stocks, bonds, GICs, or mutual funds.

Permanent Life Insurance has a long history of providing an excellent return on investment

In both good years and bad, investment returns that will pay out tax-free on death give a very high after-tax rate of return. We reviewed the historical results of the dividend scales offered by Canada Life and Manulife to find they have not fallen below 6% a year for more than twenty years.

Through a smoothing mechanism unique to specific insurance policies, investment returns offer very consistent positive gains even in negative stock market years These policies provide stable, steady results that cannot be negative.

Simply put – even if you don’t like insurance policies, you may be hard-pressed to match the reliable and consistent returns they’ve offered in the past. Remember, there is no income tax on these returns – potentially ever!

Permanent Life Insurance can provide significant tax benefits when purchased inside a corporation

On death, the money in the corporation could face heavy taxation to get the money out of the corporation. But if you instead place the money inside a life insurance policy within the corporation, much more friendly tax breaks unique to life insurance may result in the corporate cash coming out of the corporation tax-free on death. This opportunity is only possible through the use of a life insurance policy.

There are many other specialized advantages of permanent life insurance, including:

- Buying life insurance on young children can provide tax-deferred money for future schooling needs

- Buying life insurance involving grandchildren can provide generation-skipping tax advantages of moving wealth tax-free between family members

- Permanent life insurance is a very targeted and controlled way to leave money as an inheritance in family trusts for special needs family members, people in shake marriages, and spouses where you fear remarriage after your death

Who Should Consider Buying Life Insurance?

Permanent life insurance is suitable for a specific group of Canadians. It’s ideal for the following Canadian investors:

- People who have more money for retirement than they need

- People who can place some of their extra savings in an insurance policy to access the tax breaks

- People who have already taken advantage of traditional tax shelters like RRSPs and personal residences have achieved spousal income splitting, and generally are in higher income tax brackets

- People who have a well thought out estate plan and own goal to leave their heirs wealth in the most tax-efficient way possible

- People who prefer a hands-off investment style and are prepared to rely on the insurance policy to manage at least some of their investment money

- People with specialized needs for liquidity provided by life insurance on their death. Life insurance will create more liquid capital that can be used to fund tax liabilities associated with small businesses or expensive real estate

Work With Me For Your Permanent Insurance Needs:

Permanent life insurance is very complicated and similar (but different) products are offered by more than ten insurance companies in Canada. Not all of the companies provide all of the tax benefits discussed in this article.

As a chartered accountant specialized in tax and as a Chartered life underwriter (Canada’s highest credential for life insurance expertise), and as your family advisor that knows you well, I’m best suited to help you create the right life insurance product fit. Together we can design the right policy, shop all the various life insurance companies and design a solution that will correctly maximize the opportunities described in this paper.

Call me directly at 416-627-5761 Ext. 0 to discuss permanent life insurance further.

Kurt Rosentreter, CPA, CA, CFP, CLU, CIMA, FCSI, CIM, FMA, TEP is President of Upper Canada Capital in Toronto and a Senior Financial Advisor & Portfolio Manager with Manulife Securities. Kurt is the author of seven books on personal finance and a money management course instructor for accounting associations across Canada. Kurt is the past co-founder of the billion-dollar wealth management practices at one of Canada’s “Big Four” global public accounting firms. With more than twenty-five years of professional experience in Canadian wealth management, Kurt is a popular public speaker nationally and can be regularly found in the national newspapers as an expert on personal finance. Kurt has published more than five hundred articles on money in the last two decades, and his hard-hitting newsletters are popular with Canadians. www.kurtismycfo.com

Kurt Rosentreter is the author of “Wealth Building, Lifelong Financial Strategies for Success with Your Money (Revised Edition)” (2009); Wealth Building (2005); Rosentreter’s Rules 100 Financial Strategies to Achieve High Net Worth (2001); 50 Tax-Smart Investing Strategies (1998); 50 Tax-Smart Investing Strategies (Updated 1999); 50 Tax-Smart Investing Strategies (2002); 50 Tax-Smart Investing Strategies (2004). Manulife Securities has not created nor endorsed this book or any of its contents.

Any opinions, advice, statements, services, offers or other information contained in this book are those of the author and not of Manulife Securities or any of its affiliates.”Manulife, Manulife & Stylized M Design, Stylized M Design and Manulife Securities are trademarks of The Manufacturers Life Insurance Company and are used by it, and by its affiliates under license.