From the Desk of Gerdi Lito, CFA

Associate Portfolio Manager, Manulife Securities Incorporated

Gerdi.lito@manulifesecurities.ca

The Importance of Having an Emergency Fund

Life can be unpredictable and disrupting events can have a strong impact on your finances. Healthcare bills, emergency home repairs, job loss or temporary disability may leave you needing money quickly to pay bills and maintain your lifestyle, at least for the short-term.

Having some money set aside “for a rainy day” is intuitive and can make you feel safer knowing that you have a stash of cash set aside for emergencies. But how much should this fund be, and where should you hold it so it can also “earn something”?

Below are some tips on how to set up your emergency fund and better manage your cash flow:

How much should I hold in my emergency fund?

There is no exact answer here. Probably the best answer is to hold whatever amount makes you feel comfortable. For most people this is three months of spending needs, for others this can be up to a year. It depends on factors like job security, level of income and savings, health and your personality. Talk to us if you would like more guidance in this area.

Where to hold the emergency money?

One common solution is to have a separate bank account for emergency savings so that you can access funds easily. However, holding a big amount of money in a savings account may not be the best option. Despite interest rate increases over the last year, saving accounts may offer low interest rates. It is wise to hold a smaller amount in a savings account that you can access immediately and hold a bigger amount in a liquid investment that can earn you something and still serve the purpose of the “emergency fund”. High interest saving accounts (HISAs) are liquid products that you can buy in a brokerage account. HISAs currently earn much higher than regular savings accounts and generally their interest rate moves with the overall interest rates set by the Bank of Canada. You can open a TFSA or a regular investment account and keep the money in a HISA as your reserve fund. In most cases, you can access this money within three business days.

Should I also set up a Line of Credit?

Having a line of credit handy is recommended as it can give you immediate access to cash. However, a line of credit is not your emergency money, but rather a temporary tool to access cash that comes with a cost. Unfortunately, for the past ten years many Canadians have used lines of credit not only to support them for emergencies, but also to live a lifestyle that they could not afford. Now with rates at the highest in 15 years, they are feeling the impact.

Maintain the Emergency Fund

If you use your emergency fund, make it a rule to replenish it before you add to savings or spend more for leisure. It can serve as your “Treasury Account” to fund big annual expenses like trips or if you need to replace your roof, but it needs to be refilled from your regular income at the amount that you have set as your comfortable level of emergency money.

From the Desk of Mathew Cain, CIM

Associate Portfolio Manager, Manulife Securities Incorporated

Mathew.cain@manulifesecurities.ca

The Great Debate – Start Receiving the Canada Pension Plan (CPP) Now, at Age 65 or at Age 70?

What is the Canada Pension Plan?

The Canada Pension Plan (CPP) retirement pension is a monthly, taxable benefit that replaces part of your income when you retire. If you qualify, you’ll receive the CPP retirement pension for the rest of your life. To qualify you must:

- be at least 60 years old.

- have made at least one valid contribution to the CPP.

How Much Will I Receive (the Math)

The amount you receive each month is based on your average earnings throughout your working life, your contributions to the CPP, and the age you decide to start your CPP retirement pension. Your contributions to the CPP are based on your earnings.

To receive the maximum CPP benefit in retirement, you will need to contribute the maximum CPP amount per year for 39+ years between the ages of 18 and 65. However, many individuals find that they never receive the maximum due to early retirement, winding down employment in their 60’s, raising children, going to school, periods of unemployment and more.

If you start receiving your pension early, the monthly amount you’ll receive will be smaller. The government will reduce your benefit by 0.60% each month that you start CPP before age 65. This means that your overall pension will be reduced by 7.20% per year or 36% overall if you take the pension at age 60.

If you decide to start later, the government will increase your benefit by 0.70% per month if you decide to take the pension after the age of 65. This means your overall pension will increase by 8.40% per year or 42% overall if you decided to take the pension at age 70.

The government will not increase your pension past the age of 70 so there is no benefit in postponing it past age 70.

The Breakeven Points – Another Consideration

There are several breakeven points to consider when reflecting on when to take CPP.

The breakeven points are the ages when you start to receive more total benefit by delaying CPP payments.

For the simplicity of the exercise below, we used ages 60, 65, and 70. Please note that CPP can be taken at any time between the ages of 60 and 70.

We have assumed for illustration purposes that the person below is age 60, an inflation rate of 2.00%, they qualify for 75% of maximum CPP, and they receive a 4.00% rate of return.

- Taking CPP at 60 vs 65. If you live past age 75, you are better off taking CPP at age 65.

- Taking CPP at 60 vs 70. If you live past age 79, you are better taking CPP at age 70.

- Taking CPP at 65 vs 70. If you live past age 84, you are better off taking CPP at age 70.

When Should I Take CPP?

You’ve worked for the past 40 years, and you are now faced with the decision on whether you start receiving the Canada Pension Plan (CPP) benefit now, at age 65, or postpone as far away as age 70.

The simple answer is there is no best answer. Everyone’s situation is unique, and this is where a financial forecast becomes useful.

A financial forecast is a customized roadmap that ties in your CPP, Old Age Security (OAS), possible work pensions, defined benefit pension plans, investment portfolio withdrawals (RRSP, TFSA, non-registered accounts, corporate accounts, trust accounts), and maps them against your expenses after tax.

Once the data has been reviewed, we can then reflect on different scenarios that are designed for your lifestyle.

Scenarios (hypothetical)

- You plan to retire at age 60 with a defined benefit pension and so you don’t really need the CPP benefit right now and wish to defer.

- You have a large RRSP account and will draw on this first and wish to defer the CPP benefit. Drawing down the RRSP before you need to RRIF at age 72 could mean less OAS claw back.

- Your family has a history of health issues and taking CPP makes more sense at age 60.

- Your family tends to live long lives so deferring the CPP benefit to age 70 could be more advantageous.

Sources:

PPI CPP Calculator, 2023

Government of Canada, 2023

From the Desk of Jeton Spahiu, CIM

Financial Advisor Associate, Manulife Securities Incorporated

Jeton.spahiu@manulifesecurities.ca

Separating the Top Seven Market Cap Stocks from the Rest of the Pack

The Standard and Poor’s 500, or more commonly the S&P 500, is a stock market index which tracks the performance of the 500 largest companies listed on exchanges in the U.S. The S&P 500 is commonly used as an indicator of the overall health of North American and Global markets. However, the index uses a “free-float” or capitalization weighting index strategy which sees companies rise and fall based on changes in the market capitalization (total value of outstanding shares) of each company tracked (Investopedia, 2023).

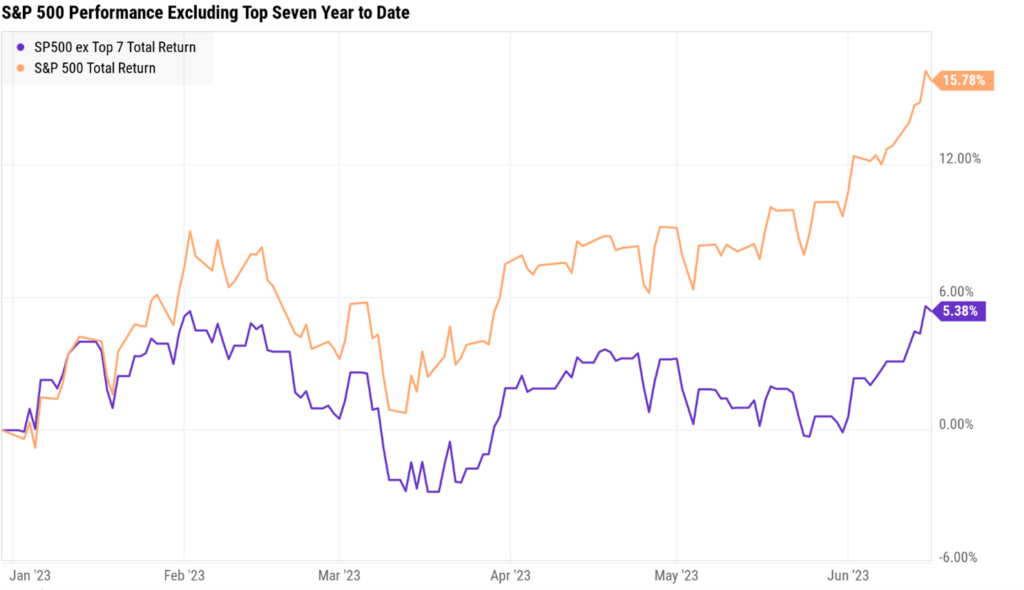

Falling inflation, unexpectedly good earnings, and massive investor interest in emerging AI technology has led to surging prices in the U.S. tech sector (Axios, 2023). The total return of the S&P 500 index is up +15.78% year to date (data sourced from YCharts on 06/16/23). However, the top 7 companies in the S&P 500 are responsible for most of the index’s performance this year. Apple, Microsoft, Amazon, Nvidia, Alphabet, Tesla and Meta have grown to make up 27.55% of the S&P 500 Index (YCharts, 2023). Rebalancing the current weightings of the S&P 500 to remove the performance of these companies, the total return would be far less at +5.38% for the year (data sourced from YCharts as of 06/16/23).

Although markets have seen a good start to the year, it is important to recognize the impact that strong performing individual stocks or sectors can have on returns and overall diversification within the index holdings in your portfolio.

Sources:

Axios, 2023

Ycharts, 2023

Investopedia, 2023

From the desk of Frank Valicek, CFP, CIM

Financial Advisor, Manulife Securities Incorporated

Life Insurance Advisor, Upper Canada Capital Inc.

Frank.Valicek@manulifesecurities.ca

Strengthening Life Insurance Coverage Protection

Some good news to share with respect to much higher levels of protection for life insurance policy holders in the event of the failure of their insurance company. The insurance member-funded nonprofit, Assuris, which protects policyholders should a life insurer go bankrupt, has materially increased both the percentage and amounts of coverage that policy holders would receive. CLICK HERE to see the full article from Advisor’s Edge. While rare, there have been a couple of instances of Canadian life insurance companies going bankrupt as recently as 2012, so it’s comforting to know that Canadians can rely on their coverage with even greater certainty than before.

Sources:

Advisor’s Edge, 2023

Disclosures

Manulife and Manulife Securities are trademarks of the Manufacturers Life Insurance Company and are used by it, and by its affiliates under license.

Manulife Securities is an indirectly wholly-owned subsidiary of Manulife Financial Corporation (MFC). MFC owns The Manufacturers Life Insurance Company (MLI), a financial services organization offering a range of protection, estate planning, investment and banking solutions through a multi-channel distribution network. MLI owns Manulife Securities Incorporated, Manulife Securities Investment Services Inc. and Manulife Securities Insurance Inc. MLI also owns Manulife Bank of Canada, a federally chartered Schedule 1 bank, which in turns owns Manulife Trust Company, a federally chartered trust company.

Frank Valicek, Jeton Spahiu, Mathew Cain and Gerdi Lito and Manulife Securities Incorporated or Manulife Securities Insurance Inc. (“Manulife Securities”) do not make any representation that the information in any linked site is accurate and will not accept any responsibility or liability for any inaccuracies in the information not maintained by them, such as linked sites.

Any opinion or advice expressed in a linked site should not be construed as the opinion or advice of Frank Valicek, Mathew Cain, Jeton Spahiu and Gerdi Lito or Manulife Securities. The information in this communication is subject to change without notice.

The opinions expressed are those of the author and may not necessarily reflect those of Manulife Securities Incorporated or Manulife Securities Insurance Inc.

This publication is solely the work of Upper Canada Capital for the private information of his clients. Although the author is a Manulife Securities Advisor, he is not a financial analyst at Manulife Securities Incorporated and/or Manulife Securities Insurance Inc. (“Manulife Securities”). This is not an official publication of Manulife Securities. The views, opinions and recommendations are those of the author alone and they may not necessarily be those of Manulife Securities. This publication is not an offer to sell or a solicitation of an offer to buy any securities. This publication is not meant to provide legal, accounting or account advice. As each situation is different, you should seek advice based on your specific circumstances. Please call to arrange for an appointment. The information contained herein was obtained from sources believed to be reliable; however, no representation or warranty, express or implied, is made by the writer, Manulife Securities or any other person as to its accuracy, completeness or correctness.

Manulife Securities Incorporated does not make any representation that the information provided in the 3rd Party articles is accurate and will not accept any responsibility or liability for any inaccuracies in the information or content of any 3rd party articles. Any opinion or advice expressed in the 3rd party article, including the opinion of a Manulife Securities Advisor, should not be construed as, and may not reflect, the opinion or advice of Manulife Securities. The 3rd party articles are provided for information purposes only and are not meant to provide legal accounting or account advice.